We build companies

In-house deal flow. Corporate optionality. Start early without all the noise.

Capital efficient companies with accelerated product development.

Beyond the Traditional Approach

We uncover technology that is often overlooked — the disruptive cleantech needed to Solve Climate+ by 2050.

We have developed in-house deal flow, a technology selection process, and an investment strategy to build capital-efficient companies with accelerated product development.

SEP is capitalizing its next funds to build companies in balanced alignment with corporate partners, entrepreneurs, innovators, and stakeholders in emerging cleantech hubs — well beyond today’s cleantech ecosystem.

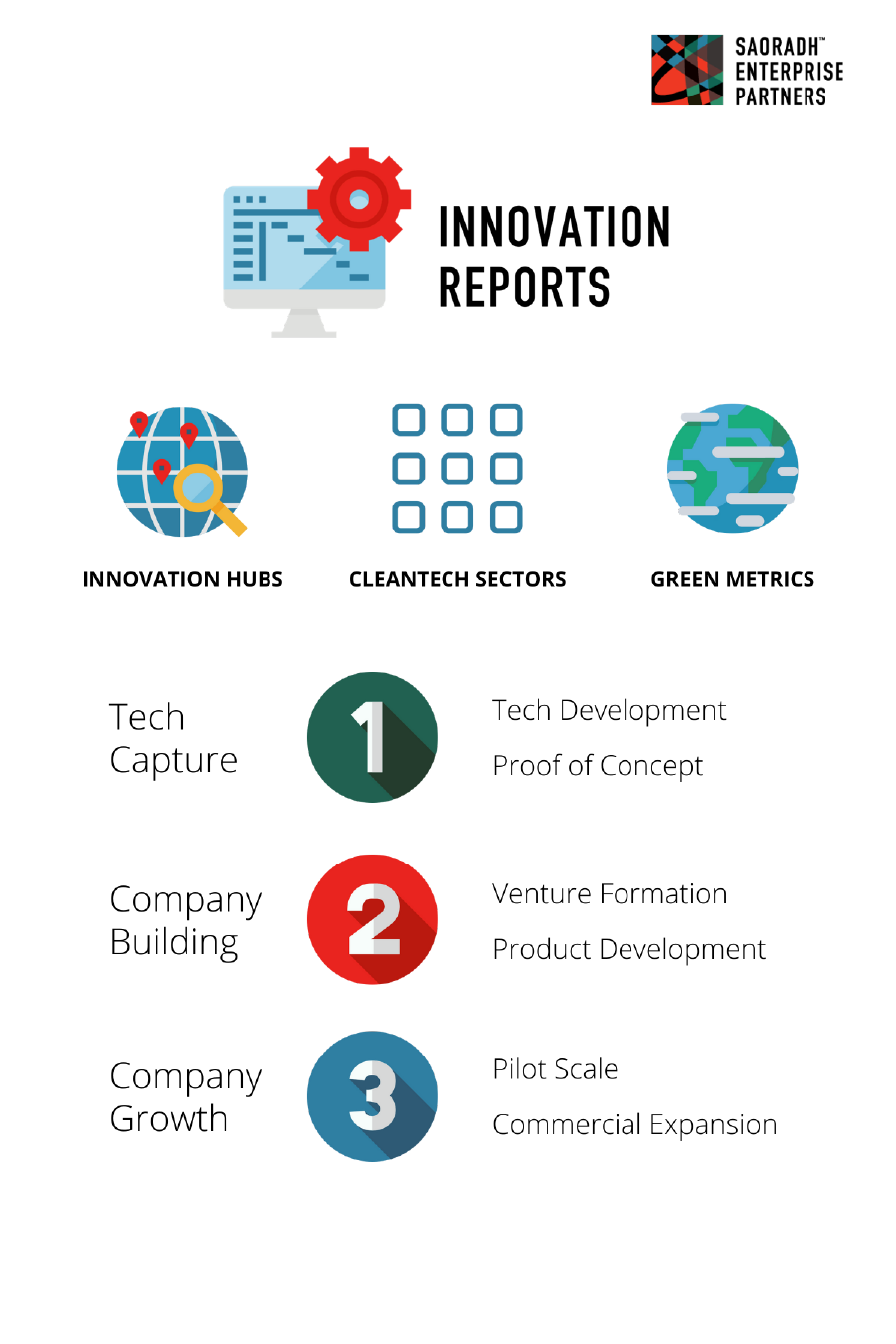

Deal Flow

We source investment deal flow for our funds and our corporate clients from Innovation Reporting, the flagship service of our research platform.

Innovation Flow Reporting identifies and tracks investible cleantech opportunities in SEP’s Innovation Hubs and as Megatopics, organized by our Cleantech Sectors and evaluated with our Green Metrics system.

Data, reporting, and analysis from Innovation Reporting spans the startup development process from tech capture to venture launch to company expansion. We invest in opportunities starting at any of the three phases of cleantech development and commercialization.

While our relationships with universities, accelerators, and other stakeholders are contained within Innovation Reporting, we will initiate challenge programs to identify overlooked innovations and startups. Of course, we are always open to reviewing opportunities brought to us via other sources.

Tech Selection

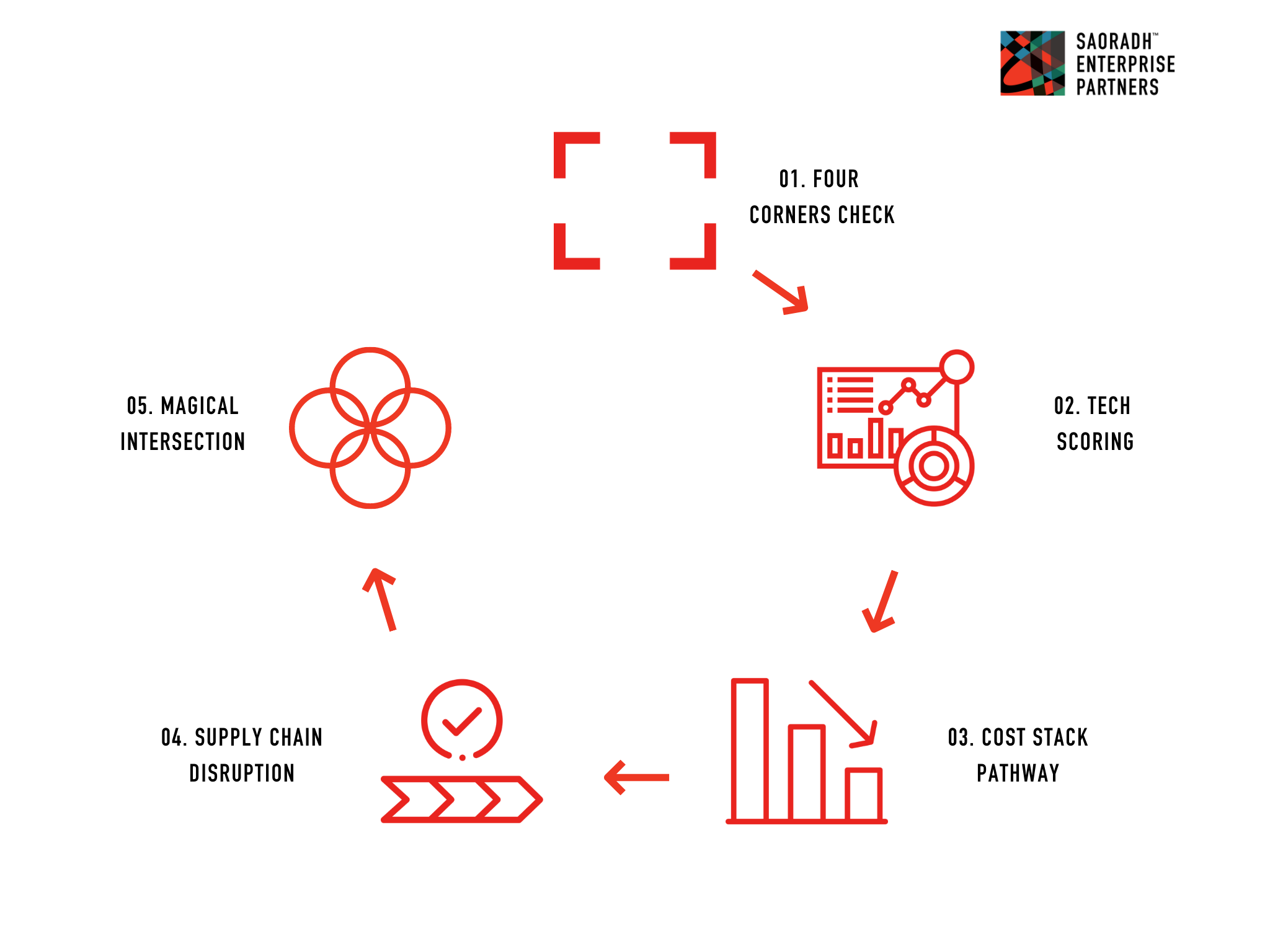

Our deal flow from Innovation Reporting and technology challenges can uncover multiple approaches to solving a particular problem.

The SEP Tech Selection system helps us sort out the best tech and whether to combine IP from multiple sources.

As a startup develops a first product from its technology or prepares to expand, we will use the same Tech Selection system to determine if it is the right opportunity.

The investment decision-making process for SEP’s funds and corporate partners relies on our TES due diligence method, which includes the Tech Selection system and adds a two-phase process to evaluate all aspects of a venture.

Investment strategy

SEP navigates tech capture, leads company building, and drives company growth with an investment strategy that builds valuable companies. This strategy provides corporate partners with collaboration opportunities and later stage investment optionality, which reserves a seat at the table with each startup. Our four investment strategy elements are:

Start Early

We work with innovators in emerging hubs to identify and track technology as it moves out of university R&D programs and through proof-of-concept. This puts us in a position to capture great technology before the competition and at better prices than overheated markets like Silicon Valley and Boston.

Company Building

SEP will minimize distractions for founding teams by avoiding constant pitch sessions, providing the primary capital, bringing support resources, and building the startup in an emerging Hub near where the innovation originated. This allows the team to focus on their plan, resulting in accelerated product development and further capital efficiency.

Company Growth

We will drive financing rounds with leading venture capital firms and corporate partners in the appropriate cleantech sector. This provides a strong capital pathway for a startup to become a growth company with well-funded pilot and commercial-scale production.

Corporate Investing Chasm

Corporates that invest in SEP seed-stage funds have participation rights in follow-on funds and can make co-investments. SEP fosters corporate collaboration with startups in conjunction with its Start Early and company-building processes. Together, this bridges the chasm between corporate R&D spending at universities and investing in otherwise competitive Series A-X rounds.

SEP’s Distinctive PortCo Support

Expert Advice

SEP senior advisors and partners are available to startup leadership. They have expertise in every key discipline necessary to build a successful cleantech company.

Vetted Resources

All professional service providers needed by a startup have been vetted and are made available to save time and expense.

SEP Community

Startups have access to leadership coaching and SEP’s interactive network of stakeholders, including curated collaboration with corporate partners.

TES Offerings

Each portfolio company receives an annual voucher to access TES resources: market and tech reports, topic briefings, financial modeling, and guidance on grants, JDAs, and IP.

Cleantech Capital

SEP will step in as early as proof-of-concept grants for our seed-stage funds and extend through bridge capital. These funds provide the primary venture capital required for product development by our startups, to produce their minimum viable product and reduce fundraising noise.

SEP’s follow-on funds will start at Series A and extend into Series X rounds to support successful startups coming out of our seed-stage funds. We expect to couple our funding with syndicates that bring portfolio companies the necessary growth capital and expertise to reach commercial scale and exits. Some of our seed-stage and follow-on funds will extend across the nine SEP Cleantech Sectors, and others will be specific to one sector.

SEP:

Proactively sources deal flow from Innovation Reporting and tech challenges.

Focuses on emerging Cleantech Innovation Hubs.

Uses our Tech Selection system to choose the best opportunities.

Vets each opportunity using our TES due diligence process to benefit SEP funds, SPVs that we manage, and corporate co-investments.

Our funds leverage the SEP investment strategy from Start Early to company-building to investor optionality.

SEP generates a rich flow of information for each LP in our funds: reporting on deal flow, tech selection, due diligence, collaboration opportunities, and portfolio company updates.

Cleantech Ventures

Launched in 2015, SEP’s first investment fund is focused on advanced fuel vehicles. Our portfolio companies are leaders in vehicle technologies, carbon-negative fuels, and fueling and charging facilities. In addition to investing our capital, we secured capital from partners and brought an array of support functions to help build these companies.

Starting in 2017, SEP also deployed its capital directly and led joint product development initiatives with Global 2000 companies, implemented quality management systems, and created go-to-market strategies. This effort focused on Forge Nano, a leading advanced materials company commercializing tech initially developed at the University of Colorado.

A Vision for a better world

Work with us

SEP’s investment strategy stems from our team’s experience at every stage of the cleantech commercialization process — including building research centers, leading tech transfer offices, developing new product divisions at F1000 companies, and being entrepreneurs ourselves. We strive to unite innovators, entrepreneurs, and corporations with the shared goal of advancing cleantech and building an environmentally sustainable world.